Does friendship exist between traders? It’s a good question with no easy answer. If you ask if there is friendship between firefighters or police officers, people will just shrug their shoulders and say «sure thing». Yes, all movies and series about heroic professions are built on it. If you are watching a series about police officers — I bet it is about partners (I dare say I will win in 9 cases out of 10). These brave guys may start off disliking each other, up to the point where they rough each other up, but in the end, they will work together, shoulder to shoulder. Firefighters will pull each other out of the fire. Soldiers will shield each other with their bodies. Superheroes will tear supervillains to shreds together and save the day. The keyword is together!

It’s great to have a friend with whom you can save the world… or at least give the Dark Lord a dusting in a very dark alley.

You’ll say that in real life that’s not always the case. That’s true. But the stories in books and movies reflect perceptions that people form about the way our life works (or how it should work). Now tell me, how often do you find musketeer stories about traders in movies?

There are friends among doctors or pilots or startuppers. There is even a series called Suits where lawyers are friends. Lawyers! Even though these guys are more likely to tear at each other’s throats than to offer a shoulder to lean on. But even they weren’t left out.

But maybe traders are not supposed to be friends?

The world of lone wolves

In the popular mind, a trader is a lone wolf. Proud, independent and ready to take on the market one on one. He stands alone at the window of his office or his studio and looks at the views of a big city from high above. He sits sadly at the bar staring at his emptying glass of whiskey. And even on a noisy trading floor or in an open space with hundreds of monitors, every trader is on his own…

These perceptions are not without reason. And here is the reasoning:

- Trading is a domain of personal responsibility. Collective farming won’t work here. You make a mistake, you pay for it.

- The market is where the money moves from pockets of losers to pockets of winners. Thus, a trader plays against other traders on the exchange market. Everyone is a rival, everyone is a competitor.

Perhaps you too think that people of our profession are fated to eternal rivalry?

I used to think so too. But one day fate gave me a chance to change my opinion. I met Steve and Chris and they dragged me from the edge of the precipice and became my loyal friends, without whom my life would have been different. Most likely, it would have been a life without trading.

It all started with a bar fight, where I smashed Steve’s nose, and he gave me two black eyes.

Although if you think about it… No, it all started with a deep shi…

On the edge of the precipice

In 2007, I made one of the most important decisions of my life — I said goodbye to the Forex sandbox and started trading as an adult, on the Chicago Mercantile Exchange, the CME. At that time, I’d already had a solid background of mistakes and achievements, and failures and victories. I’d learned to fall and get back up. I felt like one tough cookie and an old hand. I thought the sky was the limit. I was starting a new life.

Forex had been a good trading school for me — I’d made almost $300,000 there and felt that I could do even better. (At that time, there were no micro futures contracts, so it was Forex where beginners suffered their first bumps and bruises. Today you can go directly to the CME with just a thousand dollars.) After studying information about futures trading and the Chicago Mercantile Exchange, I decided that this was where I was going to make my first million. After all, futures trading is a great chance to make a lot of money quickly. Much quicker than on the stock exchange.

Leverage embedded in futures trading is a powerful tool. It increases your chances by tens, and sometimes hundreds of times. By investing a relatively small amount of personal funds, you get much larger amounts at your disposal. Roughly speaking, you can invest one hundred dollars and trade with a thousand. And if you determine the direction of trends correctly, you take the profit from this thousand.

But leverage is treacherous and it can let a careless trader down. The futures market makes you pay a heavy price for self-assurance, over-excitement, and loss of self-control. I knew all that. But I still ended up on the edge of the precipice.

How could this happen to me? After all, at that time, I already had four years of trading experience and an understanding of the importance of risk management. I knew what the mistakes affected by over-excitement and euphoria could lead to. I didn’t come to the CME to thoughtlessly waste my money. I had a plan and I had a strategy.

…And I wasted my first $20,000 deposit in a few hours. Excitement that comes with starting a new business and self-assurance blurred my vision. It was as if I sailed out of a small bay into the open sea — and the endless expanses made me dizzy! I felt like I could see new countries with King Solomon’s mines and mysterious lands with gold mines of Eldorado ahead of me… I was swept by euphoria. I didn’t notice treacherous undercurrents leading my ship to sharp reefs.

Later, I learned that this was a fairly common psychological stumbling block associated with a «shift of scenes». People experience great stress from transitioning to a new level or from pivotal life changes, even if they do not realize it. It would seem that you are well prepared to move to another country, get married, change your job, get promoted or start a business… But you are still on edge and you succumb to different emotions — from fear to euphoria — and you make mistakes.

I forgot my trading principles and started trading at high risk, and when I noticed that my ship was heading towards the rocks at breakneck speed, I lost control.

…It was a fiasco that struck a severe blow to my self-esteem. Why, oh why? I am a seasoned master, I know how to make awesome sand pies in the Forex sandbox, I know how to wave my plastic shovel the right way! I was stabbed with all-consuming resentment; a feeling of cosmic injustice descended upon me, and I started to get angry… I rushed back to the market, fiercely waving my plastic shovel.

It was stupid, sad and… laughable. The market had broken tougher traders. No wonder a brilliant trader Jesse Livermore warned his sons about the danger of fighting the market. The stupidest thing a trader can do is to refuse to recognize his mistakes, seek vengeance and chase the game.

That was what I had done. I wasted five deposits, or $280,000, in a couple of weeks — in other words, almost everything I’d made over the four years on Forex. I’ve already described the details of this story in my autobiography, which you can read on the site (if you haven’t already). I didn’t have much money left, but I had enough for a bottle of whiskey.

And I went to a bar.

Meeting «Mr. Know-it-all»

All people that were having a drink in the bar seemed to me life’s perpetual winners. They seemed carefree, satisfied and despicable. A small group of people was having fun nearby. Judging from the parts of their conversation I could hear, these were my colleagues — stock sharks. Only they were not toothless, but sharp-toothed. They were celebrating something. The fact that we were in the same place at the same time was not at all surprising. This bar was popular among traders, so every other patron here was a «bull» or a «bear». And by the looks of it, I was the only woodpecker.

«Sons of bitches…» said I, probably out loud.

Downing my tequila, I was thinking about how harshly my life had treated me. How unlucky I was. How charts on the monitors and trends on the charts ganged up on me. How wrong this all was. How unfair the universe was. Basically, I was steadily driving myself into the swamp of loser’s psychology. I was making up more and more reasons for my failure, and white wings started to grow on my back. Every drop of alcohol was making me more and more convinced that I’d done everything right and that good people simply had no luck.

«Good people have no luck,» I mumbled.

And then someone mockingly said to me, «And you, I guess, are so good, and smart on top of it?»

I turned around and saw the most repulsive face I’d ever seen. That bastard sitting nearby at the bar embodied everything I hated so much at that moment. Money. Victory. Success. Luck.

«You know, we all make mistakes,» continued meanwhile the stranger, unaware that he was seriously asking for a punch. «The point is to understand in time who is to blame for these mistakes.»

«And who am I to blame?»

«Yourself.»

My suspicions proved true. This guy obviously begged for a good blow to the jaw to bring him down a peg. I waved the bartender for another tequila. The evening was getting more interesting.

«Do you think before you speak?» I inquired.

«I do. I’m even willing to bet you a hundred bucks that I know the reason for your bad luck, my dear good man.»

I dug a hundred bucks out of my pocket and slapped it on the bar counter.

«Well?»

«You decided that the world owes you because you made it happy just by being born. And now you’re sitting here whining that you weren’t given enough luck. Others have it, but not you. And, of course, it’s not your fault you are up the creek. You blame circumstances, fate, and everyone around, except yourself. That’s your problem.»

He stretched out his hand to take my money.

«The good news is you can change everything.»

«What are you, a shrink, Mr. Know-it-all? You decided to give me a therapy session, you lucky skunk?»

«No, I am a trader. But I probably have a little bit of a psychologist in me. Trading is impossible without psychology.»

«So you’re trader? Me too! And tell you what, a few days ago, I was as cheerful and bold as you! But the market punched me in the guts so hard that it knocked the wind out of me!»

«Looks like it knocked your brains out too.»

«And you think, you’re insured against losses?»

«You don’t look like a newbie, which means you should know that no one is insured against losses in our business. The question is when you open the parachute and stop the fall. Although some manage not only to fall to the bottom but to keep digging holes there, just to bury themselves even deeper.»

The know-it-all was saying such right things that the desire to punch him grew in me with every minute.

«Are you saying I dug this hole myself?»

«Well, who else? I am 100% sure that greed, or anger, or over-excitement, or all of this together made you forget that trading is a business, and business requires a cool head. You gave in to your emotions. You turned into a gambler… It serves you right!»

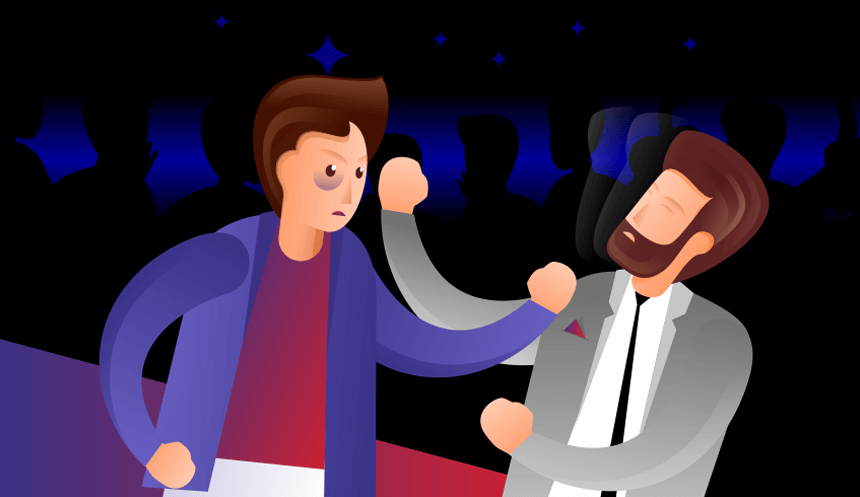

My arm shot forward on its own, like a squeezed spring, and my fist flew towards the jaw of the know-it-all. Oh, how I wanted to knock all his teeth and all his right words out of him!

He dodged and my knuckles collided painfully with the wooden bar counter.

«Aaaaah! That’s it, you’re done for, you know-it-all!»

I rushed into battle with my eyes blazed red with fury. People around started buzzing, turning to watch the fight. Someone whistled. Someone started calling the cops. What an exciting evening for the bar’s regulars!

Cold shower

I was smashing Steve, and Steve, in turn, was beating my brains out. He got me good twice — sparks flew first from one eye, then from another. My blows often landed in the air (I was likely drunker), but I accidentally hit my opponent’s nose with my head, causing him to grunt loudly and utter a strangled «Fuck!»

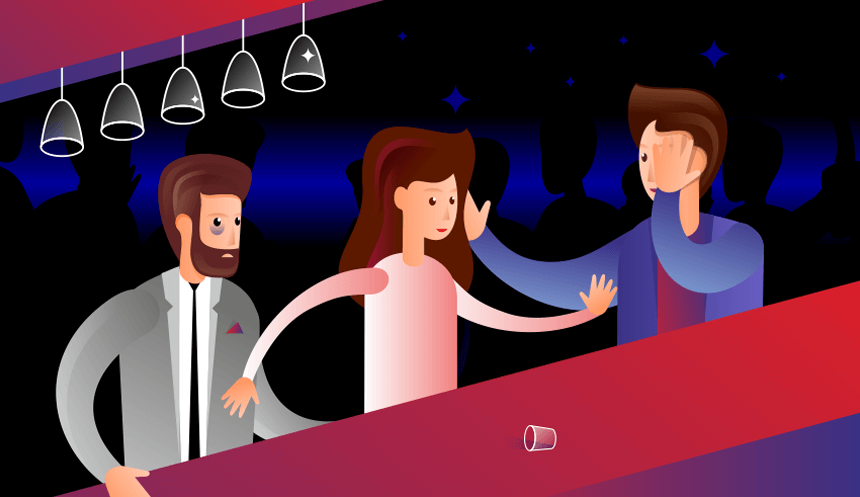

Suddenly we heard, «Enough!»

A moment later, I felt a stream of cold water falling on me. Brrr! The ice shower brought me to my senses. My opponent was shaking off water beside me. His nose was bleeding. And there was a girl with a pitcher standing over us. She looked beautiful and very determined.

After we crawled apart, I felt completely devastated. The fight sobered me. I applied ice to my swelling eyes and thought to myself how foolishly I’d been acting. Why did I go nuts on a stranger? Yeah, he said some unpleasant things. But is that a reason to behave like an ape-man with a club? Where is my control? Where is my brain? Yeah, the same place my wasted deposits are. Here’s the result of losing self-control. Idiot.

Opening my eyes with difficulty, I looked at the know-it-all. He was sitting a few feet away from me, pressing his handkerchief to his nose. We stared at each other for some time, and all of a sudden, we started laughing.

Then we stood up at the same time, stepped towards each other and held out our hands.

«Steve.»

«Mike.»

The girl who pulled us apart came up to us.

«And I am Chris.»

And that’s how our friendship began.

Lessons learned

Steve and Chris worked together for his investment mini-fund. It was their team having a party at the bar where I’d come to lick my wounds. It was their gang of lucky winners that made me so mad that I got into a fight. But when my emotions had settled, I realized that they were all great guys — not at all pompous or arrogant. They were easy to talk to.

«It is important not to get cocky in our business,» said Steve. «The moment you begin puffing up with pride is the moment you start your way to the bottom. It’s just a matter of time. I knew a guy who traded without losses for 90 days and he got cocky. He started to consider himself the smartest guy in the room, and the rest were fools to him. One day he jumped on knives and…»

Steve made a helpless gesture with his hands.

Steve himself had many more reasons to be proud since he had 184 good trading days in a row in his career! But he treated me as equal, though at that time I was, to put it mildly, off my game.

We talked a little more, roaring with laughter from time to time: our faces beaten black and blue looked too funny. I learned that Steve was born in North Carolina and by the time we met he had been trading for 9 years, first on Forex and the NYSE, and then on the CME. He started his mini-fund and supported a group of traders who were likely doomed to get thrown out of the market.

«We all fall on our butts when we begin learning to walk,» said Steve. «I was once like that too.»

And he told me how he built his first deposit working 12 hours a day and denying himself almost everything. He would stop in front of a beer rack in a store and reach out… only to remember that he had a goal… and he would put his hand back in the pocket.

«Do you know how many days it took me to waste this deposit?»

«Three? Two? One?» I tried to guess.

«Yes! One day — and I had nothing. So don’t sweat it. As the words on King Solomon’s ring said, «…this too shall pass.»

Simply put, Steve turned out to be a great guy.

The following day we were sitting in the bar again. Steve offered, «Spit it out, tell me how the market ‘did you wrong’. Then we’ll think together what we can do about it. I’m sure it’s not as bad as you think.»

I started to tell him how I got my bumps and bruises on Forex, how I worked hard to make almost $300,000 and that there was almost nothing left of it now; I told him how I worked out the principles of low-risk trading and risk management for myself. I laid out the whole story of my failure: how I put great hopes on the CME, how I wasted my first deposit, how I was upping my stakes each time and how I eventually lost $280,000… While I was talking, it was getting clearer to me: I was ruined by the desire to get revenge on the market. Yeah, Steve was right: I’d forgotten that I was a trader. I’d turned myself into a gambler I was four years ago when I first got acquainted with Forex.

Steve got interested in my trading principles (I talked about them in detail in my autobiography). In short, they imply trading in a calm state of mind, they require patience, the ability to wait, careful risk control and the ability to quit in time. All of that helped me make money on Forex. And all of that was thrown away when I jumped into the deep end of big-league trading… Steve listened to me very carefully.

«My, my! You really are a tough guy,» he said with respect. «Did you figure it all out by yourself?»

I was pleased that Steve had appreciated my approach to trading. But I was honest with myself and with him; I did work out the principles but in the end, I wasn’t able to use them on the «adult» market!

«Well, you took the first step to solving the problem,» Steve said. «You’ve admitted your mistakes. Not everyone is able to do so, that’s why 95% of traders get kicked out of the market forever. I think you’ll be able to remain in the ranks.»

The words were so simple but they were exactly what I needed to hear at that moment! I’d been crushed by the market, but what was worse, I started to destroy myself morally. And I’d almost convinced myself that after such a shameful failure I would have to quit trading. But what would I do next? Mop the floors at McDonald’s?

Steve’s encouragement brought me out of my misery. Not completely, of course, but I started seeing some hope ahead.

This time, although I drank very little, my mood significantly improved. By the way, Steve warned me that trying to drown the problem in alcohol would not help me find a way out.

«Of course, sometimes you need to have fun and relieve stress. Sometimes you even need to hit the town to reboot. But don’t you dare drink every day. Don’t kill your brain, it is your main asset. It’ll help you make a lot of money eventually…»

That was how we began hanging out, sharing our thoughts, ideas, and practices. Steve introduced me to great trading techniques, which later allowed me to seriously improve my professional skills. Such advice is worth a lot; it saves you years of your life that could otherwise be spent on trials and errors. And in return, Steve took a number of trading principles from me, noting that I’d managed to summarize what is smeared out in dozens of clever books.

«You should start writing yourself,» he said to me once. «You can articulate your thoughts and make your ideas clear really well. If you create a website and write articles for traders there, I’m sure it’ll make it to the top.»

«It’s an interesting idea,» I agreed. «But first it would be nice to learn how to follow the principles I developed for myself. I lack control and discipline… I can’t keep my emotions in check. And to be honest, I’m afraid to trade in the big league again. I panic at the thought of trading. I even wonder if it’s really my thing. Did I choose my business right? Sometimes I’m filled with such despair… I have this feeling that it wasn’t $280,000 I’d wasted, but my life, my hopes… Is it worth carrying on at all?»

«Okay,» said Steve. «You need Chris’s help.»

The girl who knocked sense into my head

As you remember, Chris was that determined girl who poured ice water on me and Steve from a pitcher. She also turned out to be a trader. I remember it surprised me back then, meeting a girl who was a trader. Really?)) Do they even exist? Trading seemed to me purely a man’s business. But, as it became clear, girls also trade on exchanges. What’s more: they do it really well!

Steve said that Chris was much less likely to make mistakes that happened from time to time to all traders who succumbed to their emotions. And this really struck me. How could this be? Everybody knows that women are more emotional.

«We are more emotional but more careful and disciplined,» Chris laughed when I asked her point-blank about it. «Men are much more inclined to take unjustified risks, they are more reckless and adventurous. Testosterone sometimes plays a nasty trick on men by not allowing them to recognize a defeat and forcing them to bang their foreheads on a locked gate. Pride and stubbornness often lead to the undoing of male traders.»

«Exactly,» Steve sighed. «I still have problems with discipline. I have breakdowns.»

«You?» I was amazed.

Steve nodded, «But I’m working on it.»

Then I realized why Steve was so interested in my trading principles. He had his weaknesses, and he was relentlessly fortifying his potential «breakdown point». And Chris was helping him with that.

Talking to Chris proved to be very helpful. Steve recommended her as a great psychologist, and that turned out to be true. Chris knocked sense into the heads of the whole team of his mini-fund. Thanks to her, I realized the importance of psychology to someone who decided to become a successful trader. And I recalled more than once later how Steve said that every trader should be a little bit of a psychologist when we first met. He got that from Chris, too.

I’m not going to retell all of our conversations with Chris, because even an entire book won’t be enough to do it. I’ll just say that to a large extent her thoughts, ideas and studies are reflected in the articles you’ve read or will read on this site.

When we started hanging out, I felt like I was in some sort of a coma. The market knocked me out and took away not only my money but also something much more valuable — my self-confidence and understanding of my place in life. Yes, I had achievements and some experience in trading, but there was also an array of problems. Both in my life and trading. Could I have solved them on my own? I don’t know. But I can tell you that I would have struggled with them a lot longer. Conversations with Chris played a huge role in my return to the ranks of stock wolves.

Following Chris’s example, I started to work hard on my self-control. Her advice turned out to be very helpful in this matter. I started a trader’s diary, where I noted not only the results of transactions but also my emotions in the trading process. It became clear to me that to achieve success on the exchange, especially when trading futures, it is necessary to learn to keep your emotions in check.

«Just don’t overdo it,» Chris advised. «When trading, you need to control your impulses without giving in to euphoria and anger. And after you are done trading, you need to get it all out of your system. You shouldn’t accumulate a psychological burden. You need to get rid of it properly. After all, any burden pulls us to the bottom…»

At that time, my burden weighed tons. There were weights on my legs that stopped me from going to the surface despite my weak attempts to splash about. And then Chris cut the Gordian knot with one strike. (I’m telling you she is a determined girl.) That’s how it happened.

Rampage, havoc and… an unexpected breakthrough

It had been six months since my failure. During this time, I’d pulled myself together piece by piece and started preparing for a new battle with the CME. Steve and Chris were very supportive of me. I was thinking through my strategy, testing the waters inch by inch and carefully working with small amounts of money I had left; I was gradually building up my deposit. But funds were easier to restore than my self-esteem. I was scared of the market, I was afraid to end up back in a spiral dive. I was afraid to spread my wings. The memory of my failure was crushing me. I kept feeling like a loser.

And one day I woke up in my office, under the table. (Back then, I rented a small office where I regularly invited Steve and Chris.) I woke up, knocked my head on the tabletop and crawled out… Oh, mama mia! Who destroyed my monitor? Who threw the poor thing into the wall?

The office of an intellectual worker (’cause that’s who the traders are) showed traces of a thorough rampage. And the monitor wasn’t its only victim. Glass fragments were lying on the floor. They were picturesquely combined with crumbs of potato chips, which were strewn on the floor and thoroughly trampled on by someone. That someone also dropped half a pizza there, and following the buttered toast phenomenon, it landed stuffing down. Or maybe it wasn’t dropped, and someone smacked it on the floor with all their force… and then the bastard knocked over a chair. And kicked my phone under the bookcase.

There were empty whiskey bottles rolled to the corners — one, two… Who drained them dry? I started to have some vague suspicions.

Fortunately, the other seven monitors were unharmed.

I looked around the room and realized that I wasn’t alone. Chris was sitting quietly on the balcony reading a book. Ok, ok, calm down! Act as if nothing happened.

«Chris?»

«Hi! You are already awake?» She was smiling brightly.

«Did you… spend the night here, too?»

«Yeah, I did.»

«Did we…»

«No, nothing like that. You slept under the table, and I was on the couch.»

«How much did I…»

«Two bottles of whiskey.»

The door opened, and Steve walked in. He dragged in a monitor.

«What happened here yesterday?» I really wanted to ask this question, but I was too afraid of the answer.

Steve replaced the monitor smiling silently.

I finally started to remember that last night we were working together with Chris. Sitting side by side at the monitors. We’d been working like this for a week. It was a difficult decision for me — to let someone in and trade, relying on their advice. «Hand in hand», you would say. We tested out the principles that were meant to help maintain control over a situation. Chris was holding back my impulses. I remember, she kept saying, «Keep it cool, keep it cool… Don’t grab this chicken feed, let the profit grow!» But we weren’t drinking at work… and yesterday I somehow got my hands on two bottles of whiskey. That was weird.

And what had actually happened to my monitor? I was afraid to think about it. It was like I was blocking my own memory. A suspicion that I’d wasted the remains of my funds last night crept into my mind… Yes, it made sense. I’d been well and truly beaten and finished my trading race with a spectacular stunt. I hadn’t had the spirit to kill myself by banging my head against the wall, so it was the unfortunate monitor that flew there instead.

What are they smiling at? That’s what I don’t get.

… I still needed to remember what had happened the night before. So, yesterday I was looking at the charts, analyzing the state of the market and marking entry points beforehand, noting the time of the future entries. And then I tried to follow the plan, but it wasn’t working out very well. Excitement was stirring me up, my hand kept reaching forward to make a bet. But if I tried to enter a trade before I was supposed to, I heard, «God damn it!»

It was Chris scolding me as if she was smacking the head of a careless student. And then I was guiltily shrinking my head into my shoulders, but I still kept messing up. And I also had problems with timely exits from transactions. In such cases, Chris took away my mouse and closed trades for me. And if I exited earlier than I was supposed to, I got it in the neck too.

«Leave the market alone! Stop twitching like you are on the electric chair! Get your hands off! Get your hands off, I said!»

Naturally, I was a nervous wreck. The guilt for the screw-ups was mixing in me with growing irritation. Chris was starting to get on my nerves. Later on, after analyzing our lessons, I realized that I was subconsciously resisting and sabotaging her advice. Both the fact that someone was disposing of my money and the fact that this someone was a girl drove me mad…

A girl! A woman teaches me, a man, how to trade! What kind of nonsense is that? I’ve already mentioned how surprised I was when I learned that there were members of the fair sex among successful traders. And what’s more, they were not some «hags», they were very cute. But even after I saw for myself that Chris was really good at trading, my testosterone-ridden subconsciousness resisted the very idea of a «woman’s council.»

«Do you think I’m stupid?» Chris once asked me directly.

«No, not at all! I know you’re a great trader, but…»

«But what? You’re not a sexist, are you?»

«You see, it’s my money! Mine! I’ve never let anyone come near my money before…»

«I see,» Chris sighed. «It’s my car, and I’m gonna drive it myself?»

«Well, yeah, something like that…»

Perhaps it was the main issue after all. I think if Steve traded with me «hand in hand», I would also resist his control (well, maybe, without the obsessive «I am a man» thoughts). I was terrified of the idea of letting the steering wheel out of my hands, even for training purposes, even if I passed it to an experienced driving instructor. And at the core of it all was the fear of losing my money. The same fear of losses that ruined so many traders. And if we dig even deeper, we will see simple greed. Alas, all misfortunes come from greed! Don’t be so tight with your money. Don’t be afraid to lose a little, just learn to make a lot.

Back then this simple truth hadn’t been imprinted in my brain yet, and so I was out of my depth and kept messing up, getting verbal «slaps» from Chris for my mistakes. And finally, I flipped out.

«Knock it off!» I demanded rudely, releasing my brakes. «Let me show you how I work. You teach me what I already know. Don’t fuss over me like a hen over a chicken. I can do it on my own…»

«Go on then,» said Chris. «Show me your first-class performance.»

…Rubbing my head that was aching from yesterday, I was shamefully recollecting the following three hours. Jeez! I stubbornly and systematically violated both my own rules and the principles that Chris had been trying to beat into my head for a week. As a result, these three hours were enough for me to ably lose all the money I’d made that day with Chris’s help.

That’s when the monitor met the wall!

I completely flew off the handle. My mind was far from clouded, it was blackened with smoke.

«To hell with all this» I lashed out. «Screw this trading, it’s just a rip-off! I can work in an office! Or at a cash register! Or as a pizza guy! That’s it, I won’t ever set my foot in trading again!»

Chris looked at me calmly and then she walked up to the mini-bar and pulled out a bottle of whiskey, which was quietly waiting for a party. And she handed me a glass.

«Here, take a break. Relax. The desire to leave the market always comes one step before the victory.»

«I’ve had enough of your advice!» I smashed the glass on the floor with all my force.

The glass clinked pathetically. I took the bottle from Chris and started drinking straight from it.

Then there were a few small trades, and then… then… and then everything was as in a fog. There were blackouts. And there were some flashbacks. I think I ended up sending a chair flying with a cry, «Be damned, you market! I’m going to bed!»

But apparently, I didn’t get far and fell under the table. Nicely done, to sum it up.

… And that was actually the whole story. Thinking back to the events of the previous night, I picked up the chair and sat down in the darkest mood in front of the monitors that had miraculously evaded the sad fate of their fellow screen. I took a deep breath and faced my fate.

There were +$143,000 in my account.

«No way!»

It turns out that I hadn’t closed a dozen small deals on different assets the night before. One of them brought me that profit.

And Chris did not close my deals to let the profit grow (lesser profits due to the fear of losses is the scourge of traders). She just sent Steve a message, «Mike is resting. Get him a new monitor.»

Steve understood everything. He’d been through a similar experience before.

I don’t remember everything about that fun night)) but the morning I will remember forever. This day was the beginning of a new stage in my career as a trader. I found my wings.

One step before the victory

Chris spent five years trading with me. Her trading principles perfectly complemented my approach and helped me develop a personal style of low-risk trading. I continue to follow these principles to this day.

Chris helped me get a better understanding of myself. We worked through mental blocks, we fought stereotypes etched in our minds and we shattered fears. One of them, for instance, was the fear of big money.

«You came to the CME to make your first million,» Chris said one day. «Are you ready to get it?»

Well, that’s a question! I almost said, «Of course, I’ll take two.» But then I started thinking. Was I actually ready to work with big money when I climbed out of the Forex sandbox and came to the field where big players were throwing a ball? Wasn’t that one of the reasons for my failure? I started to chew it over and realized that the transition was too abrupt for me. On the CME, I had to work with money too big for my mind to wrap around. It disoriented, blinded and… scared me. The calculator in my head began to smoke. The computer went out of control… However, I won’t go into detail right now, I analyzed this point closely in my biography. Which would have never been written if fate hadn’t given me a beautiful gift — a meeting with two wonderful people who pulled me from the precipice and pushed me to the stepping-stone.

«I almost quitted trading.» These words broke out of me one weekend when we were drinking wine on a summer patio in Sorrento. «And where would I be now? Not here, for sure.»

«Chris is right. The desire to leave the market always comes right before the victory,” said Steve philosophically, watching a distant sail at sea. «You don’t lose if you encounter a losing trade, you lose if you let this trade be your last.»

So can traders be friends?

Personally, I have the answer to that question. «But what about rivalry?» A skeptic would ask. Well, we don’t have any. The market is big, there’s enough money for everyone.

It is true, of course, that the futures market is a continuous movement of money from one trader to another. But you do not compete with traders directly. If your friend makes $1000 by trading orange juice futures, nothing will prevent you from making as much on the same asset. That’s why Steve, Chris and I share tips and observations and recommend each other helpful books; that’s why we talk about the outcomes of our experiments and discuss trading instruments.

By the way, scientists studying evolution argue that communities with developed principles of altruism and mutual aid tend to be more prosperous. This includes microorganisms, complex animals and human beings alike.

But what about personal responsibility? After all, I said many times in my posts and articles that traders are the ones responsible for their own decisions! That’s right, I hold to it. And I’ll say it again. Even if you rely on your friends, even if you trade «hand in hand», you are still responsible for your own trades. You can refuse to enter or exit a trade at any time. But the moment you decide to follow someone’s advice, you assume responsibility for the consequences.

Besides, we are also accountable for our choice of friends. We are accountable to our fate.

You know, I’m not a fatalist. As Pythagoras once said, «fate is blind, but you are not!» The importance of chance, of course, cannot be denied — everyone who traded on exchanges knows it. But we do choose how to react to chance events. And it is crucial not to miss a good chance in the stream of these events.

By the way, do you remember how our brawl with Steve started? It started with my comment about bad luck. Since then, I have completely changed my opinion about the role of luck in our lives.

Now I am sure that success in trading is not luck, but the result of hard work. But I’m lucky to have met Steve and Chris.

This meeting has turned my life around. Firstly, I found a visible roadmap to success and that massively increased my motivation. They say that the environment is important for a reason; toxic people pull us to the bottom, and successful people make us reach for the top.

Secondly, our exchange of experience proved very useful for my professional growth. Thanks to Steve and Chris, I leveled up my discipline; and their trading techniques were helpful as well.

Thirdly, their support gave me confidence.

And most importantly, I know that if any of us ever needs help, we will always have a friend’s shoulder to lean on. If we need to meet, we drop everything and set a meeting. Even if we have to take a plane.

Maybe it was meeting Steve and Chris during a difficult time in my life that made me want to help newcomers with trading. By the way, Steve has recently joined me in this endeavor. Steve noticed once that I looked a bit tired. And, of course, he asked me in what fields I was overworking myself. I told him about the club and the stream of beginners’ questions. I confessed that I was wondering if I had punched above my weight.

«What kind of friend are you!» Steve exclaimed. «Having fun and not asking me to join in! I’d give you a black eye for this like in the good old days, but I can’t be bothered to make the effort. Hand the feedback over to me, and go hang out in your club))»

So the Telegram channel of the MonsterTraders club has now two people working on it, me and Steve. And where is Chris? We’re meeting her for dinner in a few hours, and she promised to tell us about a couple of new tricks.

And that’s it, it’s our simple story. I’ve reread it now and no, I don’t think they will make a series about us! There were no awesome plot twists and nothing was out of the ordinary. We live, we work, we take breaks and help each other. We no longer beat each other’s faces)) We’ve been friends for more than ten years. And now I can safely say that friendship in trading does exist.